how are property taxes calculated in fl

So the estimated property taxes on new construction homes in this area will be the sum of the mill levy plus the school district plus the township tax. A local millage rate a dollar amount per 1000 of.

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Cape Coral Florida Condos For Sale Cape Coral

This is an annual rate soassuming that tax rates remain consistentyou will pay 11250 every year.

. The basic formula is. The median property tax on a 24750000 house is 259875 in the United States. If you would like to calculate the estimated taxes on a specific.

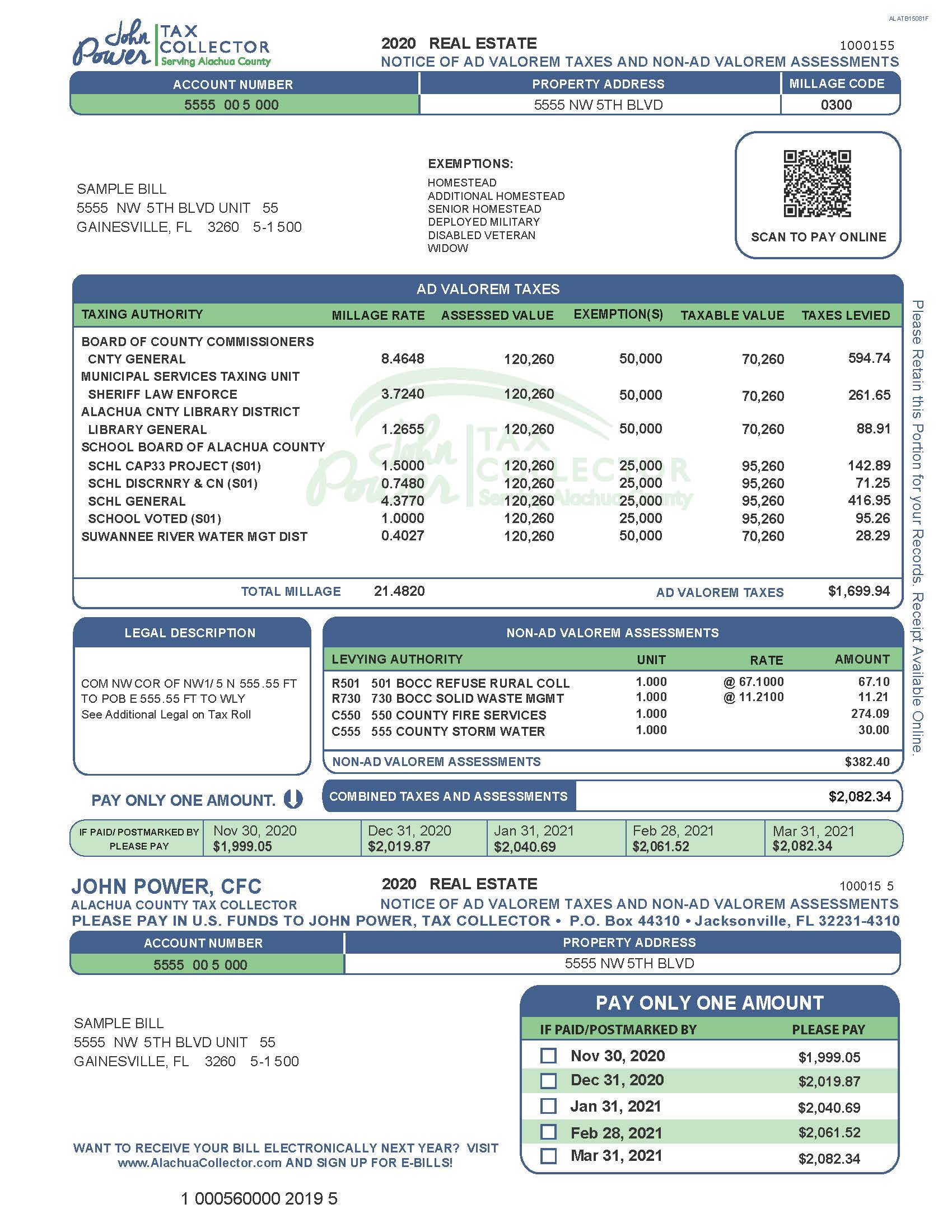

JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value. Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value. The typical homeowner in Florida pays 2035 annually in property taxes although that amount varies greatly between counties.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. Property taxes in Florida are implemented in millage rates.

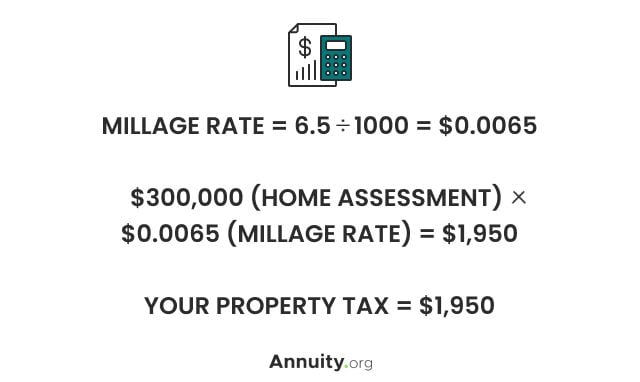

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys taxable value. Multiply the propertys value by 45 to arrive at your tax bill.

The median property tax on a 18240000 house is 191520 in the United States. The states average effective property tax rate is 083 which is lower than the US. A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. The rates are expressed as millages ie the actual rates multiplied by 1000. The local property appraiser sets the assessed value to each property effective January 1st each year.

Property Tax in Florida. Property taxes in Florida come in a bit below national averages. Property taxes are determined by multiplying the propertys taxable value by the millage rate set each year by the taxing authorities.

For instance if your home is assessed at 190000 and your general property tax rate is 225 then your residences total tax assessment for the tax year would be 4275 225 X 190000100 4275. The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. Property taxes fund public schools libraries medical services infrastructure and roads.

Assessed Value - Exemptions Taxable Value. Florida is ranked number twenty three out of the fifty states in order of the average amount of property. Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property.

For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of 25000 plus. Just Value - Assessment Limits Assessed Value. The median property tax on a 24750000 house is 267300 in Broward County.

Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value. Taxable Value X Millage Rate Total Tax Liability. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

The assessed value estimates the reasonable market value for your home. Property taxes make up a portion of your monthly mortgage payment and based on the size and condition of your home they may represent anywhere from a few hundred to a few thousand dollars. With each subsequent annual assessment your.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. 69 rows The average Florida homeowner pays 1752 each year in real. This tax estimator is based on the average millage rate of all Broward municipalities.

Taxpayers may choose to pay next years 2019 tangibleproperty taxes quarterly. Local governments levy property taxes on property owners within their locality. Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. 097 of home value.

NEW HOMEBUYERS TAX ESTIMATOR. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

The median property tax on a 18240000 house is 176928 in Florida. This simple equation illustrates how to calculate your property taxes. Calculating South Florida Property Taxes As you create a budget and save up to buy a home in South Florida its important to estimate every cost and fee youll have to pay.

Governments use taxes to provide taxpayers with various services including schools police fire and garbage collection. Tax amount varies by county. Property taxes are calculated by applying an assessment ratio to the propertys fair market value.

The median property tax on a 24750000 house is 240075 in Florida. 10 mill levy 10 school. Property Taxes on new construction homes in areas with top school districts may require an additional 10 school district tax and another 10 township tax.

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. How are property taxes calculated in Orange County Florida. Florida property taxes are computed on the taxable value To obtain the taxable value determine the assessed value of the home less eligible.

If your millage rate were dropped to 15 your tax bill would also decrease and you would only have to pay 3750 in property taxes every year.

A Guide To Your Property Tax Bill Alachua County Tax Collector

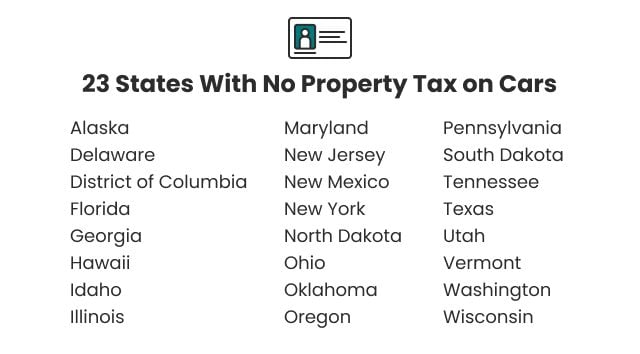

What Is Florida County Tangible Personal Property Tax

Where Are The Lowest Property Taxes In Florida Mansion Global

Florida Property Taxes Explained

Soaring Home Values Mean Higher Property Taxes

Property Tax Comparison By State How Does Your State Compare

Florida Property Tax H R Block

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

Reasons To Own A Home Home Ownership Buying First Home Tampa Real Estate

Tax Implications Of Canadian Investment In A Florida Rental Property Madan Ca

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

How Taxes On Property Owned In Another State Work For 2022

Property Taxes Calculating State Differences How To Pay

Property Taxes Calculating State Differences How To Pay

20 Buyer Seller Tips Instagram Posts For Realtors Real Etsy Instagram Posts Real Estate Agent Marketing Real Estate Tips

Property Taxes Calculations Rates Video Lesson Transcript Study Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)